Seattle Gun Tax

As you may know the Councilman Tim Burgess is proposing a $25 tax per gun on firearms sales and transfers (excluding the person-to-person sales) in the city of Seattle, and $0.05 tax per round on ammunition bought in Seattle.

This is why this proposal is a really bad idea.

Financials

First, the basic arithmetic behind the proponents' numbers is grossly unsound. The supporters of the proposal claim that it will generate the revenue of $300000-$500000 that will be used to treat the victims of gun violence.

These projections have absolutely no basis in reality.

Here are the very real number from Precise Shooter for the first half of FY2015:

- Local firearms sales, which would be subject to $25 tax: 612 guns, total expected tax: $17925

- Total number of ammunition rounds sold: 115160, total expected tax @ $0.05 per round: $5758

Assuming my store is roughly half of Seattle business, multiply this by 4 and you get the more realistic total for the year: $95000

Real financials

But this, of course, assumes that people just tighten the belt and hand over the money. There is absolutely no reason for them to do so. Seattle have 2 dedicated gun stores, a couple of pawn shows that dabble in firearms, and a couple

of box stores that sell a few firearms, like Big 5 - though I've only seen someone actually buying a firearm in Big 5 once.

However, just outside Seattle (within 1-3 miles from the city limits) there are plenty more:

- Adventure Sports

- Lynnwood Guns

- Great American Guns

- Top Guns

- Joe's Guns

- D.J's

- AMS Guns

- Wade's

- LowPriceGuns.com

- West Coast Armory

- Pinto's

- CAR Firearms

- Discount Gun Sales

...and even more if you go a little bit farther to the North or South.

So there is absolutely no reason for consumers to go to Seattle, where prices will always be significantly higher, for their gun needs. There are tons of options just outside the city.

Perhaps we could just pay the bill ourselves to keep the prices competitive?

Our store is run very efficiently. It has only two employees, and a state of the art software system which tracks all the merchandise, connects to NICS

for background transfers, and efficiently handles all the paperwork. I wrote it myself and I am extremely proud of it.

Yet in the last 6 months we had gross profit of $66000 on sales of $416000. We earned further $6000 on the transfer fees. We have spent $42000 on salaries for the

two employees in the store, so the net before the other operating costs for 6 months is $30000. Is it reasonable to expect that we - the "firearms industry" - can

afford the tax bill of $23500 on this meager income? No. This would certainly put us under.

And, in fact, if Seattle did enact this law, Seattle gun stores would simply go out of business. My store certainly would, and I don't think there are stores which

are run more effectively than mine. Which means that not only Seattle wouldn't get the revenue that the proponents project - it would lose the sales tax revenue

that it gets now from the current gun sales.

During the first 6 months, Seattle earned just over $13000 in revenue from the sales tax collected by my store. Quadruple that, and just over $50000 is what Seattle

is guaranteed to lose, per year, if the law is enacted. That, an a bunch of decently paying jobs (at at least $15 an hour, though we pay our employees more than the

city mandated minimum).

Legality

As the proponents point out, they expect the lawsuits if the law were to pass. The state of WA does have a state preemption law which prohibits municipalities to

introduce more restrictive firearm regulations than already exist under the state law.

RCW 9.41.290

The state of Washington hereby fully occupies and preempts the entire field of firearms regulation within the boundaries of the state,

including the registration, licensing, possession, purchase, sale, acquisition, transfer, discharge, and transportation of firearms,

or any other element relating to firearms or parts thereof, including ammunition and reloader components. Cities, towns, and counties

or other municipalities may enact only those laws and ordinances relating to firearms that are specifically authorized by state law,

as in RCW 9.41.300, and are consistent with this chapter.

The proponents think that this is legal because this law concerns taxes, not regulating the firearms.

However, as we have seen above, fiscally the law makes no sense - with it, Seattle stands to lose money, not gain it. Which means that the law is not about generating the revenues, but about

regulating the firearms, so it is inconsistent with the WA State law.

Luckily, the author of the law was not very subtle about it, declaring his intent thus:

...and thus...

(source, archived)

So it is about gun regulation after all, not about money - and therefore illegal under RCW 9.41.290. The above quotes will be "exhibit one" if this were to pass

and we would be forced to sue.

Basic fairness

When a firearm is recovered by the police under questionable circumstances - lost, stolen, captured at the crime scene - the FBI issues a sequence of

tracing requests that eventually reach the firearms dealer who sold the gun. I have been in this business for 4 years now, with thousands of firearms sold -

and I have only been on the receiving end of a tracing request a couple of times - less that one tenth of one percent of the firearms sold by Precise

Shooter end up in the wrong hands. Yet 99.9% of the customers would be stuck with the tax should this law pass.

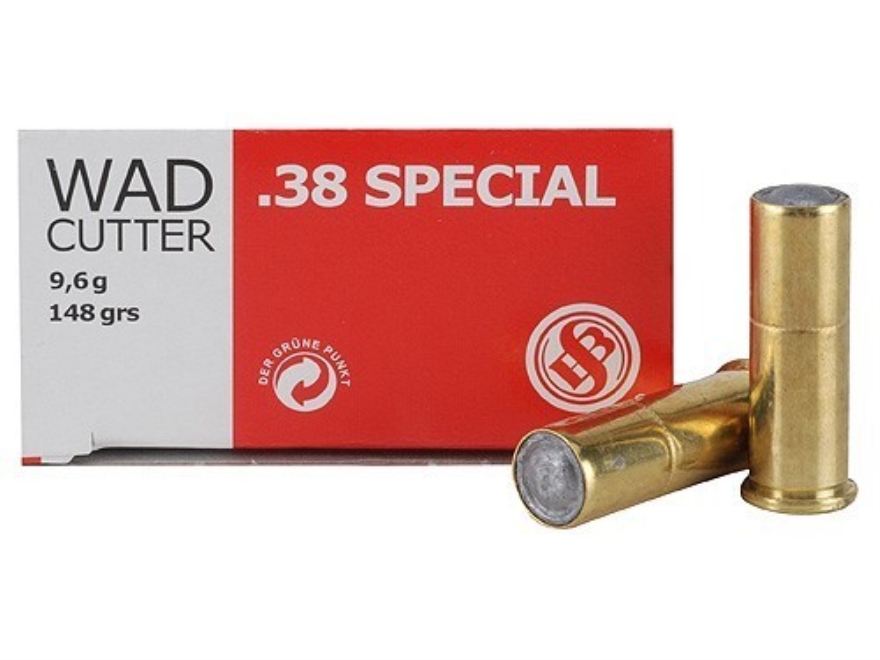

It gets worse when it comes to ammunition. There are two types of ammunition - sporting and self-defense. Sporting ammunition is designed for target

shooting and hunting small animals. Self-defense ammunition targets people and large wild animals. It is self-defense ammunition that ends up used

in crime.

What is the difference? Self defense ammunition has a hollow point bullet which looks like this:

When this bullet strikes the target, it mushrooms and tumbles in the body to inflict maximum damage, where a regular, round nosed or flat point bullet

used in sporting ammunition would just pass through.

The hollow point bullets are pretty difficult to make, so all target ammunition uses either round nosed bullet, or wad cutter bullets which produce

a very nice, round, paper puncher type holes which are easy to measure.

Another type of ammunition which is used almost exclusively for target practices is 22LR. This ammunition is very inexensive ($0.05-$0.07 per round),

and target shooters go through hundreds of them during a single visit to the range.

Hollow point ammunition typically costs in the vicinity of $20 per 20-25 rounds. For it, a tax of $0.05 per round would constitute a 5% increase.

The target ammunition ranges from $3 per 50 rounds for 22LR (almost 100% price increase due to the proposed tax) to $10 for 50 rounds (25% increase)

for typical sporting 9mm cartridge.

In the last 6 months we sold 115160 rounds of ammunition, of which only 2465 rounds were self-defense hollow points suitable for the use in crime - less

than 2.5% of the total. Of course, none of it was probably used in actual crime, and instead it is sitting locked in safes of law abiding citizens.

This means that if the tax were to pass, wast majority of the ammunition taxes - in our case, $5600 per six months - would be paid by the sportsmen

for the ammunition which is unsuitable for killing, and only $120 or so in tax would be due for ammunition that could be used in crime.

I don't think anyone would be discouraged for buying ammunition for crime use because of this - but sportsmen would be strongly affected.

Summary

So in conclusion, the proposed tax would penalize sportsmen, drive firearms sales - and the associated sales tax revenue - out of town, and will have

absolutely no effect on the amount of firearms or ammunition in the city because people would simply buy it elsewhere.

This law should not pass.

Please call Seattle Council Members Tim Burgess (206-684-8806), Sally Bagshaw (206-684-8801), John Okamoto (206-684-8802), and

Jean Godden (206-684-8807) and ask them to abandon this misconceived piece of legislation.

Or, if you prefer to email, here are the addresses: 'tim.burgess@seattle.gov'; 'sally.bagshaw@seattle.gov'; 'John.Okamoto@seattle.gov'; 'jean.godden@seattle.gov'