How to accept a transfer

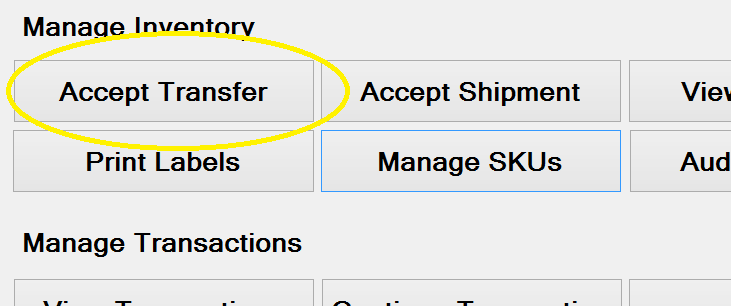

Accepting a transfer is substantially similar to accepting the shipment. It is initiated by clicking "Accept Transfer" on the main screen.

It is incredibly important that a transfer be accepted as a transfer, NOT a stock receipt. Stock is treated very differently for tax purposes. To minimize

the number of errors, the software will not let you sell an item if it is accepted as a transfer - and vice versa. Please, VERIFY that your transfer receipt

transaction is entered as such!

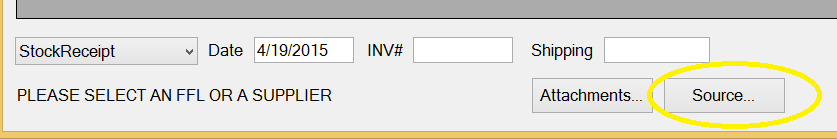

Please enter all costs associated with shipping into the shipping box. Please note that when you commit or park the transaction, the shipping cost will

be added to the costs of the items, proportionally to their prices, as the shipping is a part of cost of goods. So ONLY ENTER IT ONCE!

Please note that some distributors split cost of shipping across multiple lines - they might have an item for "handling fee", "fuel surcharge",

"adult signature surcharge" and the like. Total them all and add to the shipping box.

Shipping costs are subject to state tax, and it is imperative that you enter them correctly!

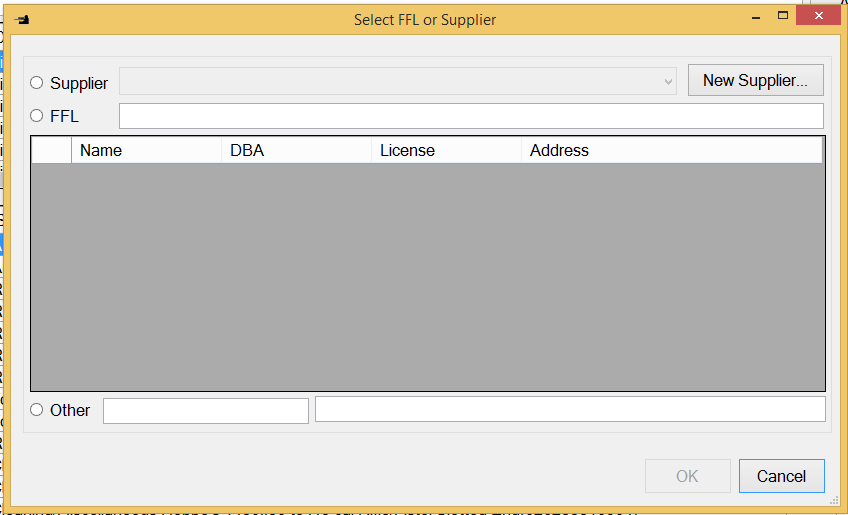

Select the source of the shipment by clicking the Source button.

A source of the Transfer Receipt should almost always be either an FFL or Other (only if we receiving from an individual directly, in which case his or her

name and address should be entered in the Other fields). One exception is AIM Surplus (Advanced International Marketing), which is also one of our distributors.

AIM should be selected as a distributor.

As in stock receipt, scan the documents accompanying the transaction using the attachments button.

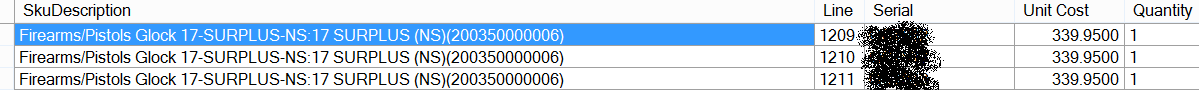

After the basics have been taken care of, use the filter field at the very top of the form to enter the items. Any search string would work but mostly you want

to go either by UPC or a model number. When you scan a UPC, the item will be added automatically, if we have a defined SKU for it. If the item requires a serial

number, it you will be prompted to enter it.

Everything that we accept in transfer transactions should be firearms, and this require serial numbers. They will be added to transaction roster one by one,

with serial numbers. You will also need to enter the FFL book line number before you will be able to commit the transaction.

Please note that occasionally other items will be shipped alongside the firearms that we transfer - accessories, occasionally, ammunition in different

shipments, etc. These should always be kept in one box, BUT PLEASE DO NOT ENTER THEM IN TRANSFER TRANSACTION. We are not required to collect use tax

on non-firearms - paying this tax directly to the state is the responsibility of the customer.

Of course accessories should be treated separately ONLY when they are not part of the firearm package as shipped by the manufaturer. For example, AXIS XP

rifles come with a scope. The scope is placed on the firearm by the manufacturer, is part of the standard retail packaging, and should not be treated separately.

However, a person might buy a rifle and a Leupold scope which does not originally come with the rifle, and the seller might put both items in one box.

In this case, Leupold scope is treated separately for tax purposes.

When the shipments combine firearms and non-firearms, allocate shipping approximately by weight, if the cost of the firearm is dominating the shipment.

For example, a sling that cost $20 might be packaged with a firearms that costs $700. Since the cost/weight impact of the sling is negligible, apportion

all of the shipment cost to the firearm.

Alternatively, a crate of ammunition might be sent in a different shipment to us, but the invoice might combine the shipment of the firearm and the shipment

of the crate into one number. If the weight of the ammunition is roughly the same as the weight of firearm, allocate approximately one half of the cost

of the shipment to the firearm.

In another example, a very expensive Leupold scope might be part of the shipment. Though it weighs almost nothing, its cost has a dramatic impact beause

of insurance. If the price of accessories approximately equal the price of the firearm allocate approximately 2/3 of the cost of the shipment to the firearm.

If the prices of accessories dramatically exceed the cost of the firearm, allocate 1/2 of the shipping cost to the firearm.

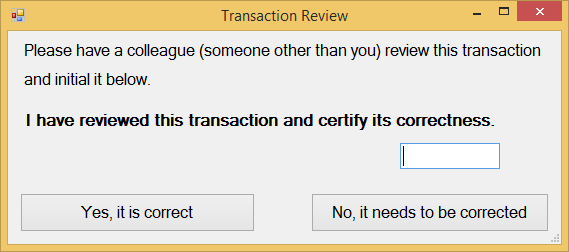

When committing the transfer receipt, you will need to have a coworker to review it to make sure everything has been entered correctly. He or she

will have to initial the transaction electronically, when Commit button is pressed.